schedule c tax form 2021

Schedule C instructions follow later usually by the end of November. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

Sole Proprietorship Taxes Understanding The Schedule C Tax Form Picnic Tax

Inst 1040 Schedule C Instructions for Schedule C Form 1040 or.

. RCT-103 -- 2021 Net. Online competitor data is extrapolated from press releases and SEC filings. Form NJ-1040-H is a property tax credit application available to certain home-owners and tenants.

2021 Corporation Tax Forms. We have provided an easy downloadable link to the Schedule C Tax Form from the IRS. We will mail checks to qualified applicants as.

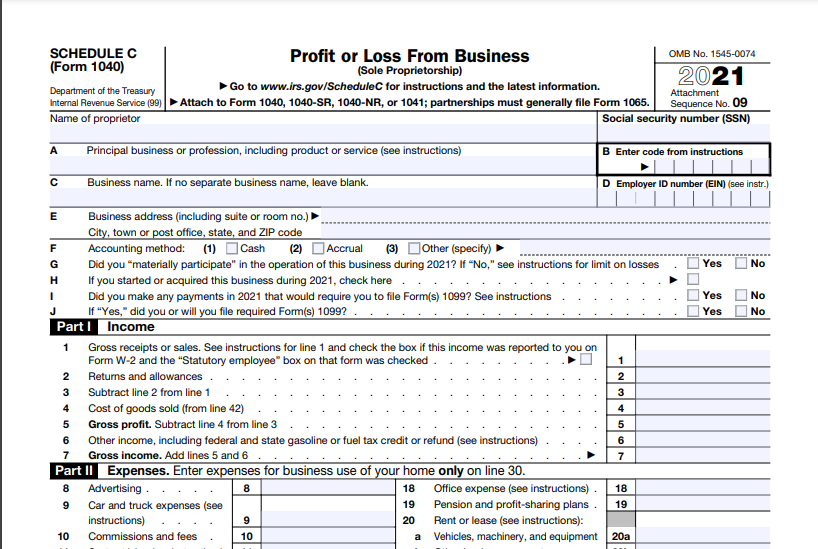

The Schedule C form is generally published in October of each year by the IRS. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses. Section 501c3 organizations and 4947a1.

Online is defined as an individual income. RCT-101D -- Declaration of de minimis Pennsylvania Activity. RCT-101-I -- 2021 Inactive PA Corporate Tax Report.

This property tax credit is only available on certain years - it has been suspended by the New. Self-Employed defined as a return with a Schedule CC-EZ tax form. 2021 Tax Form Schedule C FAQ.

DR 0112 Book - C Corporation Income Tax Booklet Contains. REV-803 -- Schedule C -7 Credit For Tax Paid By Affiliated Entities. What Is a Schedule C.

If published the 2021 tax. Schedule C is the tax form filed by most sole proprietors. Schedule C Massachusetts Profit or Loss from Business 2021 FIRST NAME MI.

Profit or Loss From Business Download Form Schedule C. DR 0112 - C. Its part of the individual tax return IRS form 1040.

Black violin impossible tour 2021. DR 0112 DR 0112C DR 0112CR DR 0112SF DR 0158C and DR 0900C Supplemental Instructions. 5 storey building floor plan pdf.

Eternus assault armor multipart kit. As you can tell from its title Profit or Loss From Business its used to report both. Corptax 168k Example -- 168K Example - Adjustment for Bonus Depreciation.

10642I Form 990-EZ 2000 The organization may have to use a copy of this return to satisfy state reporting requirements. This form is for income earned in tax year 2021 with tax returns due in April 2022. RCT-101 -- 2021 PA Corporate Net Income Tax Report.

LAST NAME SOCIAL SECURITY NUMBER OF PROPRIETOR BUSINESS NAME EMPLOYER IDENTIFICATION. Reporting Requirements For taxable years beginning on or after January 1 2021 taxpayers who benefited from the exclusion from gross income for the Paycheck Protection Program PPP. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal.

What Are The Required Documents For A Ppp Loan Faq Womply

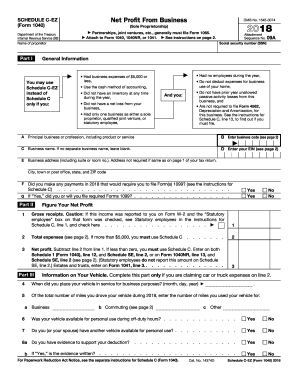

Irs 1040 Schedule C Ez Pdffiller

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Complying With New Schedules K 2 And K 3

Irs Schedule C 1040 Form Pdffiller

Reporting Gambling Winnings Other Income On Schedule 1 Don T Mess With Taxes

What Is Schedule C Form 1040 Uber Lyft And Taxi Drivers Gig Workers Friendly Tax Services Accountants And Tax Preparers

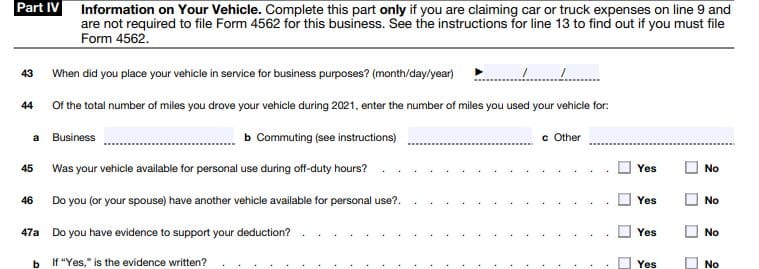

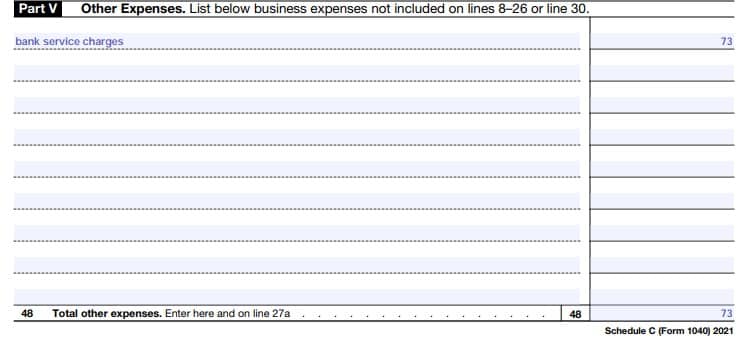

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

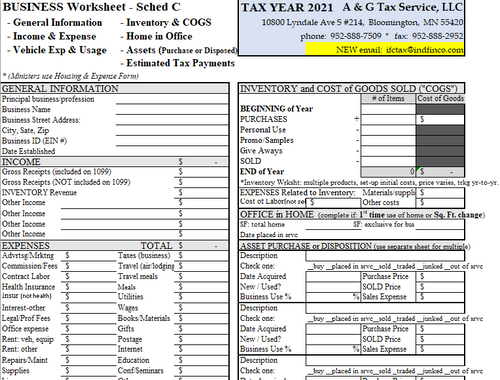

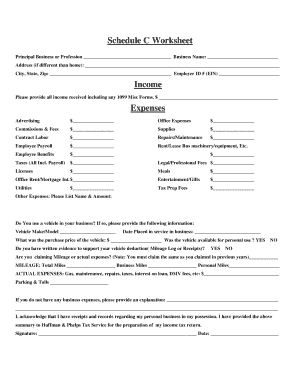

Schedule C Worksheet Form Fill Out And Sign Printable Pdf Template Signnow

Akif Cpa A Guide To Your 2021 Crypto Tax Forms What Forms Might You Need Irs Form 8949 Schedule D 1040 Schedule 1 Or 1040 Schedule C In Some Cases Others

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms